Employee Benefit Trends

How care can address employees' growing financial crisis

Key takeaways

- Employees’ financial health is in freefall, and workers are increasingly looking to their employers for help.

- Employers can improve talent management outcomes with care that improves employees’ holistic health, including their financial well-being.

- Organizations should pair direct financial support, through compensation and benefits, with educational resources that help employees make the right financial choices.

After more than a year of rampant inflation, employees across the country find themselves facing unprecedented levels of financial stress.

Employee financial health has taken a nosedive. Today, just 55% of employees consider themselves financially healthy, down 14% year over year. Mental health is on the decline, too — and, of the 35% of employees who report poor mental health, nearly half (48%) point to financial concerns as the primary reason why.

These trends spell trouble for employees, who may face yet more financial struggles with a possible recession on the horizon. They also create a crisis for employers looking to safeguard their talent.

While employers are, by and large, aware of their workers’ financial concerns — and the negative effect that poor financial well-being has on organization-wide outcomes — many still underestimate the scope of the problem. Employers currently overestimate their employees’ financial wellness by 28%. And, although more employers report offering financial wellness benefits and programs, just 54% of employees report feeling satisfied with their financial wellness benefits/programs, down from 59% in 2021.

Addressing the growing financial health crisis requires holistic employee support

Looming financial uncertainty has raised the stakes for employers, as talent look to organizations for ongoing financial support. Simply offering financial benefits is no longer enough, and our research has identified a new opportunity for employers to support workers’ well-being by delivering employee care

Employee care is a holistic and multi-dimensional approach to meeting employees’ needs. Rather than taking a piecemeal approach that addresses one concern at a time, employee care takes a "big picture" view of employee wellness that enhances holistic well-being, including financial health, from the ground up.

Together, these five elements of the employee experience, layered on a foundation of fair compensation, cultivate a healthier workforce that’s more loyal and engaged — and less financially stressed.

Demonstrating care to address employees’ financial wellness

Our research has identified four opportunities for employers to tailor employee care to enhance employees’ financial health.

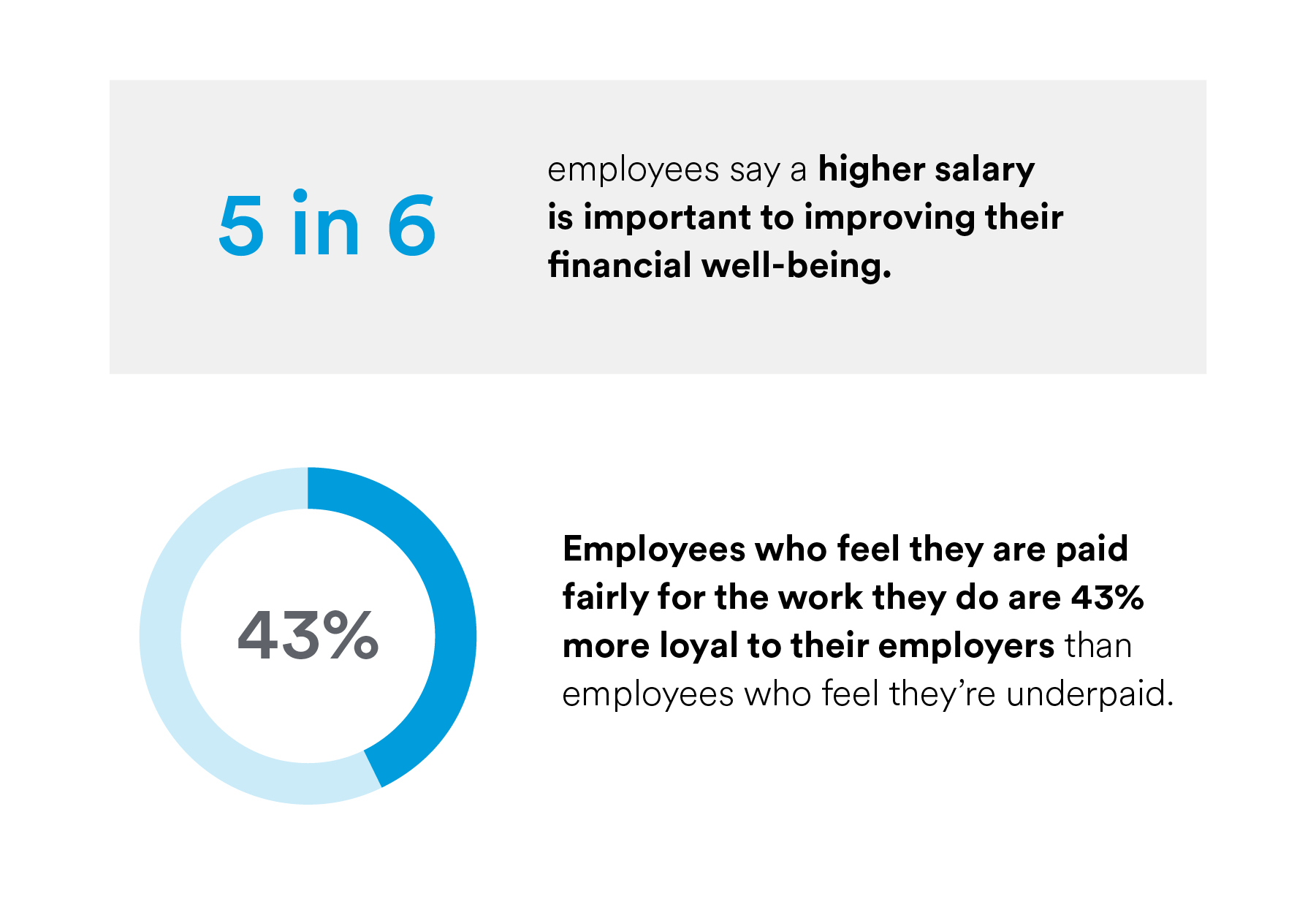

1. Look for opportunities to increase compensation

Fair compensation forms the foundation of employee care. And, perhaps, not surprisingly, pay is top of mind for employees as they assess their financial situation.

Whenever possible, employers should weigh the expense of increasing compensation with the long-term cost of turnover, and explore strategies to increase pay in order to bolster retention.

2. Offer affordable financial wellness benefits and programs

Workplace benefits and programs are central to employee care, and they can also play a pivotal role in financial well-being. However, as costs of living rise, workers are increasingly looking to their employers to ensure benefits are affordable and accessible.

Roughly 7 in 10 employees say the affordability of the benefits offered to them plays a key role in feeling cared for, and 68% identified employer contributions to the cost of their benefits as an important aspect of care.

As a result, employers should look for opportunities to reduce employees’ out-of-pocket expenses as part of their larger strategy to deliver employee care.

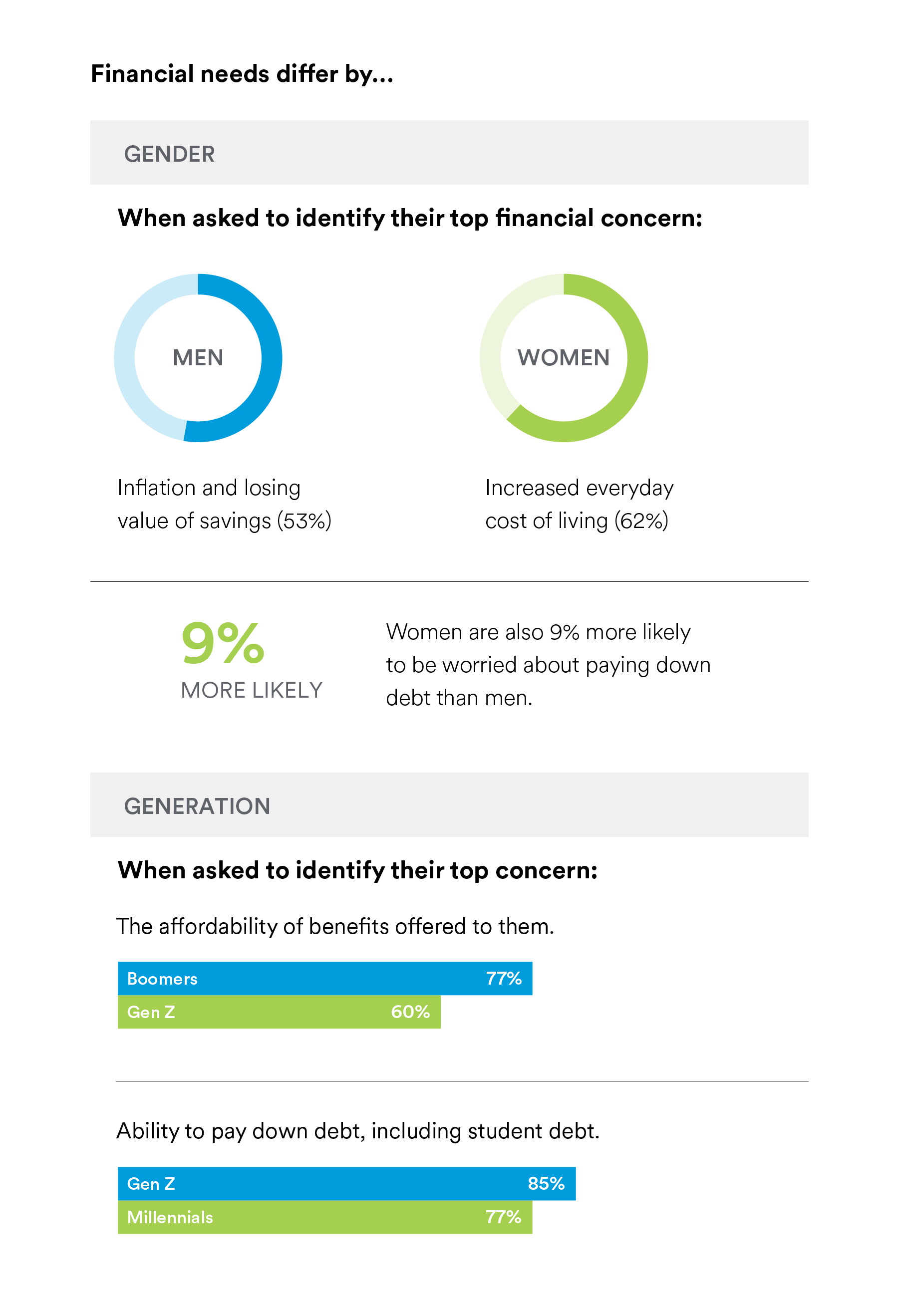

3. Meet the heterogeneous needs of today’s workforce

Improving employee financial wellness doesn’t just call for meeting one set it needs — it requires meeting several. Employees from different walks of life often require different types of support, so employers must take a multifaceted approach to financial wellness to improve outcomes across their organization.

Employers can support a heterogeneous workforce by offering a range of financial wellness benefits and programs, as well as allowing employees to customize their benefits packages to select the benefits that best meet their needs.

4. Empower employees to take control of their financial health

Ultimately, employees are in the driver’s seat when it comes to their financial health, and employers can demonstrate care by providing the tools employees need to reach their goals.

Employers should consider supporting their employees’ financial wellness with a no-cost, multi-channel approach designed to meet employees where they are. These tools should not only educate but help employees make informed decisions to take action. Resources like educational workshops, personal guidance, and a financial app help manage day-to-day expenses, help pay down debt, such as with student loans, and save for retirement.”

Finally, employers can support their workers’ financial wellness with clear, tailored benefits communications that highlight how workplace benefits and programs impact financial health. By shedding light on what each benefit does — and the real-world impact it can have on employees’ financial goals — employers can help their workers make the most of their benefits and maximize the positive impact of workplace benefits across the organization.

Future-proof your organization by focusing on employees' financial health

As employees face mounting financial pressures, employers have an opportunity to set themselves apart by caring for employees’ financial health. Those who take steps to foster financial wellness — both directly, through compensation and benefits, and indirectly, through educational resources — set their organization up to succeed by bolstering productivity, loyalty, and engagement.

Learn more about how employers can enhance loyalty by

GET THE REPORTResearch Methodology

This article contains data collected for MetLife’s 21st Annual U.S. Employee Benefit Trends Study, but not reported in that publication. MetLife’s 21st Annual U.S. Employee Benefit Trends Study was conducted in November 2022 and consists of two distinct studies fielded by Rainmakers CSI – a global strategy, insight, and planning consultancy. The employer survey includes 2,840 interviews with benefits decision makers and influencers at companies with at least two employees; companies must provide benefits to US-based employees. The employee survey consists of 2,884 interviews with full-time employees ages 21 and over, at companies with at least two employees in the US.