Work

I spend a lot of my time with small business owners, and whenever I do, I always come away filled with admiration — so many of you are truly optimistic, fueled by the passion you have for your businesses. I am impressed with your outlook, and so I also want to share some words of advice: don’t let that optimism override your pragmatism. The most successful business owners strike a balance between hopefulness and realism.

The latest MetLife and U.S. Chamber of Commerce Small Business Index, which surveys 1,000 small business owners across the U.S. every quarter, reflects the optimism I see every day.

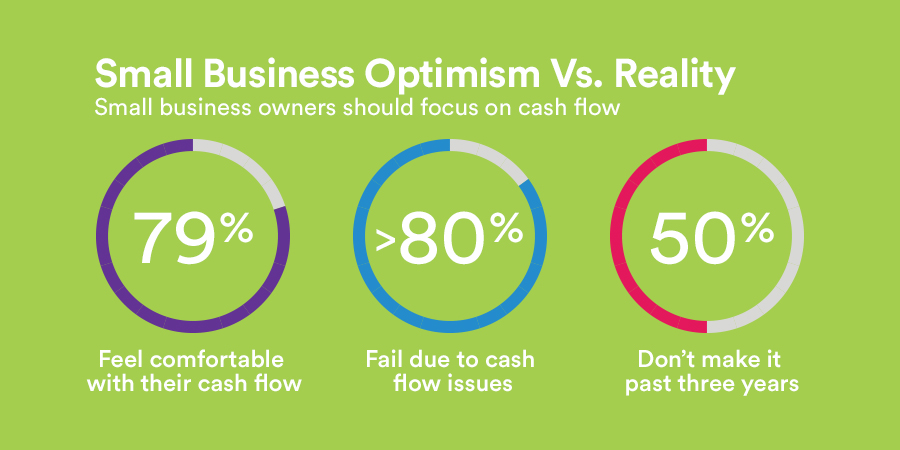

One key finding is that a majority of those surveyed (79%) feel comfortable with their cash flow — yet cash flow issues are among the leading causes of business failure in the United States (by some estimates, over 80 percent). According to the U.S. Bureau of Labor Statistics, only half of businesses make it past their third year. Triangulate those statistics, and it is clear that cash flow is an area to watch carefully.

The good news: there are things that you as a small business owner can do today to focus in on your cash flow and keep your business strong, no matter what the future holds.

To succeed long term, you have to pay attention to what accountants call “working capital” — current assets minus current liabilities, or, what’s left over when you take away what you owe from what you have in the bank. Working capital pays the expenses of running your business while you are waiting to get paid by your customers. If you run a business where customers pay on a net 30, 60 or 90 basis, you may be waiting quite a while. Be sure to have enough free cash on hand to keep going without incurring additional debt until that money comes in.

That likely seems relatively basic, but in addition to managing your working capital, don’t forget to make sure to have a separate fund to use if you are faced with a catastrophic event, including fire, flood, loss of a key employee, or a sudden illness that prevents you from working. Having a “rainy day fund” is critical to ensure you don’t fall into debt.

Unfortunately, the latest MetLife-U.S. Chamber survey revealed that one-third (33%) of America’s small businesses have no rainy day fund at all, leading them to rely on family, friends, or personal credit cards to stay afloat in the event of an emergency. If your business pays lower taxes this year due to recent tax reforms, think about directing some of those savings into an emergency fund.

Of course you’re going to keep that rosy outlook, but be aware of the facts – an estimated 25 percent of businesses don’t open again after a major disaster, according to the Institute for Business and Home Safety (IBHS), so you need to be prepared. Even if you have business insurance, how would you keep your business running if you suddenly had to close your doors? One solution is to consider a business recovery plan in case of a disaster — natural or human-caused. This step-by-step guide from the IBHS is a great resource to create one.

The bottom line is that small business success starts with you, the business owner. Stay optimistic and stay realistic — take ownership of your finances and prepare for the unexpected. Achieve that balance, and you’ll be ready for whatever comes your way.

To explore benefit solutions for your small business, click here.