MetLife Retirement & Income Solutions

For our latest study, MetLife commissioned a survey of 238 defined contribution (DC) plan sponsors and 50 advisors to assess their attitudes about stable value as a capital preservation option, including:

- How plan sponsors access stable value options

- Stable value’s historical performance vis-à-vis other capital preservation options

- Steps taken to manage target date fund volatility

- Stable value as a mechanism for smoothing out volatility in TDFs, including custom TDFs

Stable value is a capital preservation option that offers earnings stability and liquidity, while delivering a guarantee of principal and interest.

Want more insights from the 2024 Stable Value Study report?

Why Stable Value is Valued

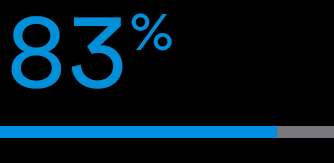

of plan sponsors view stable value as a good capital preservation option because of its long-term, historical performance

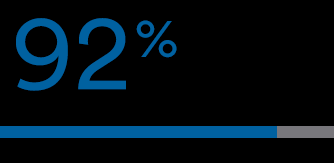

of plan sponsors are not planning to make any changes to their stable value offerings

of plan sponsors say stable value funds are valuable to plan participants seeking a safe haven

With few companies expecting to make any changes to their stable value offerings, it is clear from our research that plan sponsors – and their advisors – are staying the course with this capital preservation option.

Did You Know?

Recent market volatility has highlighted a potential gap in the market that could be filled by a target date fund solution that allows for volatility smoothing for a portion of the fund assets, particularly for investors who are near or in retirement. One such strategy uses the long-standing principles of stable value to reduce the fund’s volatility by wrapping the fixed income and a portion of the equities within the glidepath.

Conclusion

Whether including stable value as a capital preservation option in a DC plan – or leveraging the principles of stable value in new and creative ways – the outlook for the future of stable value remains strong.