MetLife Retirement & Income Solutions

For our 2024 Pension Risk Transfer Poll, MetLife commissioned a survey of 250 defined benefit (DB) plan sponsors who have de-risking goals for their pension plans. This Poll assessed:

- The driving forces behind plan sponsors’ decisions to de-risk their plans

- The role of consultants and other key stakeholders in determining the best risk transfer approach

- The activity plan sponsors are most likely to use to transfer risk

- Why the pension risk transfer market is expected to remain robust for years to come

Macroeconomic conditions – including rising interest rates, rising inflation and increased market volatility – are the top catalysts prompting plan sponsors to de-risk.

Want more insights from the 2024 Pension Risk Transfer Poll report?

Annuity Buyouts the Most Desired De-Risking Strategy

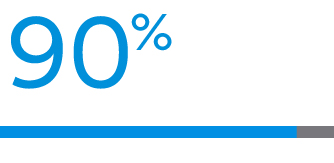

have been closely tracking estimated market pricing for annuity buyouts

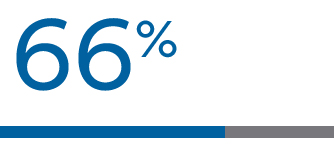

say an annuity buyout is the PRT activity they will most likely use

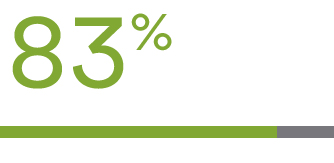

will lift-out retiree liabilities of $1B+

Did you know?

Most plan sponsors are concerned about missing a window of opportunity to secure an annuity buyout with very competitive rates.

Conclusion

With favorable annuity buyout pricing, now may be the right time for plan sponsors to decide if they should contract with a financially strong, reputable and experienced insurer to take on the responsibility of paying those guaranteed pension benefits.